How will you spend your money life?

Create a friendly, flexible plan and spend it well with BudgetBuddy

Get Started for Free

It's easy! No payment required.

We're on a mission to build a better blueprint for spending and saving.Scroll Animations

What will you accomplish with BudgetBuddy?

Pay off debt and stay out for good

Be less stressed about money

Save more money without feeling restricted

Feel organised about my finances

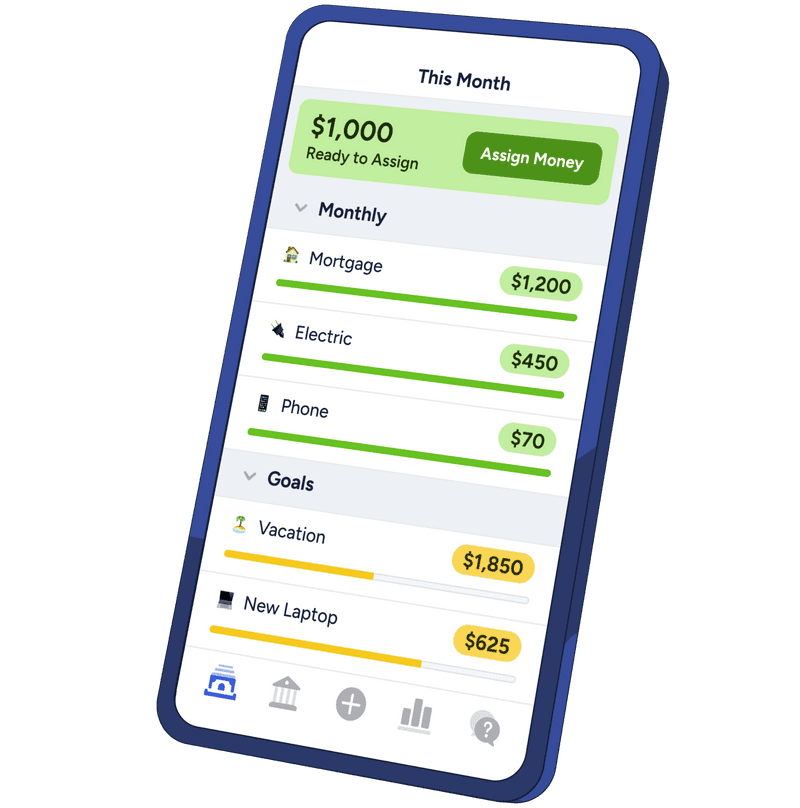

Goal Tracking

Prioritize spending and savings goals with our powerful target setting features, and track your progress at a glance.

Smart Workflows

Automate financial tasks and optimize your spending patterns with our AI-powered workflow tools.

Net Worth Tracking

Get a complete view of your assets and liabilities with real-time net worth calculations.

Any Questions?

Find answers to common questions that you may have in your mind.

What is this BudgetBuddy?

Ever feel like your money just disappears into thin air? One minute you have it, and the next, poof—it's gone! This budgeting website helps you track your income and expenses, set financial goals, and finally figure out where all your money is going (spoiler: probably food and online shopping). With smart tracking and insightful reports, you can take control of your finances like a pro.

Is this website free to use?

Royalty fees are typically around 5.9% of gross sales, plus additional marketing contributions.

Is my financial data secure?

Absolutely! We use top-notch encryption and security measures to keep your data safe. Your financial secrets are safe with us—we won't judge your spending habits, even if you spend more on takeout than groceries.

Can I access my budget from different devices?

Yes! If you create an account, your budget travels with you—whether you're using your laptop, phone, or a borrowed tablet from a friend

Can I set spending limits for different categories?

Yes! You can set spending limits for essentials (like rent) and non-essentials (like your ever-growing sneaker collection). If you go over budget, we won't yell at you—but we will send you a friendly reminder that maybe, just maybe, you should slow down on the impulse purchases.

Do I need to create an account?

Only if you want to save your data and access it from different devices. If you enjoy the thrill of losing all your financial records every time you clear your browser history, feel free to skip registration! But for a seamless experience (and to avoid budget-related heartbreak), we highly recommend signing up.

Can I share my budget with my partner or family?

Yes! If you're co-budgeting with someone, you can share access with a partner, roommate, or even your dog—though we recommend giving financial control only to humans.